MOROCCO: PRESENTATION OF THE MEASURES INTRODUCED BY 2021’S FINANCE LAW.

09/01/2021

The Finance Law (FL) of the year 2021 was marked by measures seeking to prepare the economic recovery of the country with regard to the encouragement of investments and hiring in order to absorb unemployment. For these two main purposes, the FL provided investors with several tax advantages.

In this article, we will illustrate the most important t measures introduced by 2021’s finance law.

- Corporate Income Tax

- Extension of the deadline for the assets brought into business to the Real Estate Investment Trusts (OPCI)

The FL 2021 has extended the advantageous tax regime for the assets brought into the business to these funds from the 1st of January 2018 until the 31st of December 2022.

- Extension of the benefits provided by the tax regime dedicated to the Real Estate Investment Trusts (OPCI) for residential rentals.

The FL 2021 has extended the advantageous tax regime of these trusts to cover the residential rentals as well.

- Income Tax

- Exemption from payroll tax for the first recruitment

This exemption is granted, during the first 36 months from the date of recruitment, to employees under the following conditions:

+ The employee must be recruited under a permanent contract;

+ The employee's age must not exceed 35 years;

+ The recruitment must be carried out between January 1st and December 31st, 2021.

- Exemption from interest paid to resident individuals.

The FL of 2021 provided to exempt from the income tax the interest paid to resident individuals, not subject to the income tax according to the RNR or RNS, in respect of loans issued by the Treasury until December 31, 2021, and whose interest is paid for the first time from January 1, 2021.

- Exemption from payroll tax granted to employees who lost their jobs due to Covid 19 crisis.

As a transitional measure, the finance law 2021 has exempted from payroll tax the employees who respect the following conditions:

+ The gross salary is capped at 10 KMAD;

+ The employee has involuntarily lost his job due to covid-19 pandemic during the period from March 1st to September 30th, 2020;

+ The exemption is valid during 12 months from the hiring date;

+ The recruitment must be done during the year 2021;

+ The employee must have benefited from the indemnities granted by the Social Security (CNSS) in case of job loss².

+ The employee cannot benefit twice from this exemption.

- Value Added Tax (VAT)

The most important measure introduced by the finance law is the internal exemption without right of deduction for photovoltaic panels and solar boilers.

- Registration Fees (DE)

- The FL 2021 exempts the following deeds from the payment of registration duties:

+ Deeds and writings relating to the transfer of assets and liabilities relating to renewable energy installations.

+ Acts recording loans on shareholders’ current accounts, and also those relating to obligations and recognition of debts.

- Extension of the registration fees’ reduction for the purchase of residential properties:

- Reduction of the registration fees rate for operations relating to constitutions r capital increases by in-kind contribution.

Deeds recording company constitutions and capital increase operations by in-kind contribution carried out from January 1st, 2021, are recorded at the reduced rate of 0,5% instead of 1%.

- Social Solidarity Contribution (SSC)

For this year, the FL reactivated the social solidarity contribution on profits and incomes.

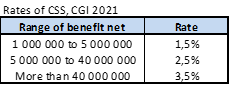

- For the legal entities, the applicable tax rates are listed below, depending on the carried-out tax result:

- On the other side, naturals persons which yearly income from Moroccan source is above MAD 240K will be subject to a contribution at a rate of 1,5%..

- Transfer Pricing (TP)

The FL 2021, reorganized the TP’s obligation of communication. In fact, in order to harmonize the Moroccan tax system with international tax standards, the FL 2021 limits the obligation to communicate documentation on TP to companies that have carried out transactions with companies located outside of Morocco and to which they are directly or indirectly dependent when:

+ Their realized and declared turnover is greater than or equal to MAD 50M exclusive of VAT or;

+ The gross assets appearing on their balance sheet at the closing of the concerned financial year are greater than or equal to MAD 50M.

This documentation includes:

+ A master file containing information relating to all the activities of the affiliated companies, the overall applied TP policy and the distribution of profits and activities on a global scale;

+ A local file containing specific information to the transactions that the verified company carries out with the related companies.

- Cancellation of fines, penalties, surcharges and collection costs

The FL 2021 cancels the penalties, fines, surcharges and collection costs relating to taxes, duties and taxes provided for by the Moroccan Tax Code, assessed before January 1st, 2020, if the payment is made before July 1st, 2021.

|

NAZALI TAX & LEGAL |